By: Wexus Technologies

Here’s a dirty secret: growers, processors, homeowners, and commercial businesses are spending too much money on solar energy installations. When many people think about their energy usage and getting relief from high electric bills, the first thing that comes to mind is to call a solar company for a quote. I’m here to tell you, pause and take a deep breath before making that call…

Don’t get me wrong, harnessing the power of the sun is an incredible technology. And the revolution of clean, renewable energy will help our future generations thrive for years to come. But the challenges with actually installing solar power reside in the upfront costs and return on investment.

If you call a solar company first, here’s what’s going to happen: they’ll take a look at your current energy bills and usage, and then size a photovoltaic (PV) system to match and offset your current energy usage. No doubt you will also want to size the system to match your usage, as the solar energy is cheaper than the energy you’d purchase from your local utility.

And keep in mind that solar is a 20 – to 30-year investment. So, if you purchase a solar PV system based on today’s usage, you could end up oversizing the system. And more importantly, you could overspend for unnecessary solar panels, particularly if your energy usage decreases, or energy prices change.

It’s the equivalent of flood irrigating a crop field for 24 hours straight, when drip irrigating for a few hours might do just as well, or better. So why do it the same way with energy?

What should you do instead?

Here’s a better approach to addressing your high electric bills: focus on the low-hanging fruit first. Smaller, lower-cost energy efficiency investments can have a larger impact on your energy usage and, ultimately, your bottom line. So, what are some examples of agriculture efficiency projects with high impact and high return on investment? Consider these:

- Selecting and continuously tracking your most cost-effective utility rate plan based on your actual energy usage

- Monitoring and maintaining irrigation pump efficiency above the industry –standard of 60%

- Irrigating during less expensive “off-peak hours” to avoid power demand surcharges

- Installing variable frequency drives (VFDs)

- Upgrading insulation and windows at cold-storage and food-processing buildings

- Installing LED lighting, lighting control systems, and daylight and motion sensors

- Upgrading to high-efficiency HVAC systems

The Wexus team calls this whole-farm, energy-saving approach “Reduce Before You Produce.” Before considering a solar PV installation, we highly recommend a “whole-farm” energy audit to determine a baseline of your historical usage, costs, and energy-consuming equipment across your entire farming operation.

For example, we’ve analyzed thousands of irrigation pumps. If one of your irrigation pumps is operating at 45% efficiency and the industry standard recommended level is 60%, you could be wasting tens of thousands of dollars every year. Simple preventive maintenance or repairs could cost a few hundred to a couple thousand dollars. However, they will be quickly paid back through energy savings in just a few months.

Now multiply these efficiency gains across all the irrigation pumps across your farm. Five pumps, 10 pumps, 20 pumps, 50 pumps, or more? The savings multiply as your operation grows. In this case, not only do you spend less money to generate kilowatt-hour (kWh) savings, but you also reduce the size and costs of any solar PV system, should you choose to install one.

After you’ve harvested your low-hanging “energy fruit” and driven the maximum energy savings possible across your farm, then it could be time to call the solar company to properly size a system for you.

Not convinced yet?

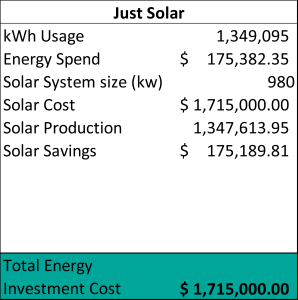

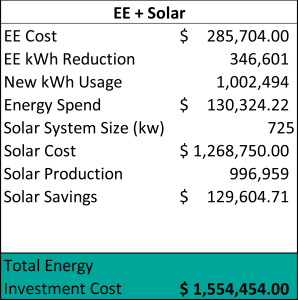

Here is a real-world example:

Above is a real-world example of one of our customer’s solar PV system investment costs before (and after) implementing energy efficiency projects. In this case, a farmer was leaving over $160,000 on the table by oversizing their solar PV system. What would you do with another $160,000 in operating income for your business?