By: Andrew Valainis

Director, Montana Renewable Energy Association (MREA)

According to the Solar Energy Industries Association, the cost to install solar has dropped more than 60% over the last decade alone, with the average residential system costing half of what it did in 2010.[1] Still, solar photovoltaic systems are a large investment, and the up-front cost can be challenging for many Americans. In this blog post, I will explore some of the financing and financial incentive options available to help pay for these systems. I use Montana’s available options as examples, though financing and incentive programs will vary state to state.

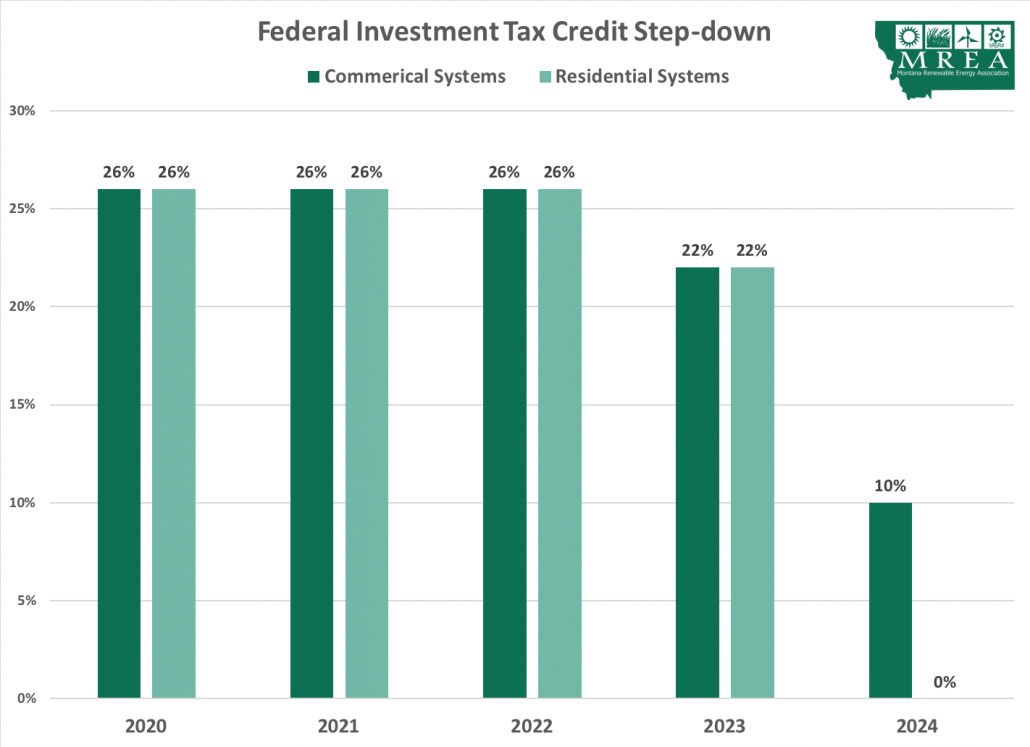

One of the most popular and most important incentives in the U.S. is the Solar Investment Tax Credit (ITC). The ITC is a federal income tax credit that you can claim against the cost of the installation. This credit applies to the total cost of the installation, including labor. If you decide to install a storage system at the same time as the solar system, then you can include that cost as well. There is no upper dollar limit on how much the credit is worth. The ITC was originally set at 30% but stepped down to 26% in 2020 and will continue to step down over the next few years. In 2020, the phase-out schedule was extended for two years as part of the spending bill that Congress negotiated. The ITC will remain at 26% until 2023, when it will step down to 22% for all customers. In 2024, it will expire for individuals, while stepping down permanently to 10% for businesses.

Another great option is the U.S. Department of Agriculture’s “Rural Energy for American Program” (REAP). The REAP program provides grants – not loans – to qualifying agricultural and small businesses for up to 25% of the cost of a renewable energy project, up to $500,000. Energy efficiency grants and loan guarantees are also available through the program. This is an excellent option for agricultural producers. USDA has local offices all around the country, and I highly recommend calling them to ask about the program and how you can benefit.

In 2022, Congress passed the Infrastructure Investment and Jobs Act (IIJA), which provides a large amount of funding for the installation of renewable energy technologies. Details are still coming out about several of the different funding opportunities, which may apply to businesses or individuals. These are worth monitoring for further information. You can learn more here.

Some states offer state-level programs specifically supporting the development of solar and other renewable energy technologies. In Montana, we have the Alternative Energy Revolving Loan Program (AERLP). This program was established by the Montana Legislature in 2001 and provides zero-down, low-interest loans of up to $40,000 to individuals, small businesses, nonprofit organizations, and government entities in order to increase investments in alternative energy systems and energy conservation measures in Montana. The program, managed by the Montana Department of Environmental Quality’s Energy Office, has financed more than 500 renewable energy installations across the state since its first loan in 2003. States also often offer tax incentives or rebates for renewable energy installations, which are great options to help lower the up-front cost of the installation. Reach out to your state energy office or solar advocacy group to ask what options your state offers.

Property Assessed Clean Energy (PACE) programs are becoming more popular across the country. PACE programs offer the opportunity to finance the up-front cost of an installation and then pay back that cost as an assessment on the property taxes of the building or location where the system was installed. One of the greatest benefits is that the cost of the system is tied to the location, making for a simpler process if there is a change in ownership. The nuances of these programs are important and will vary from state to state. For example, the recently adopted PACE program in Montana is only available to commercial entities.

Your utility may offer discounts, rebates, or other incentives that can help with the cost of renewable energy and/or energy efficiency technologies. In Montana, we have the Universal Systems Benefits (USB) program. Our largest investor-owned utility, NorthWestern Energy, administers this state-authorized incentive program through its “E+ Renewable Energy Program” to qualifying non-profit organizations, government agencies, and schools in NorthWestern Energy’s Montana service territory. Projects receiving these funds often provide civic value, including education and visible representation of renewable energy technologies to a broad audience. The Montana USB program provides grants, but other utility territories may offer programs with discounts or rebates on certain energy efficiency products. Reach out to your energy provider to ask what incentives it offers.

Private financial institutions are beginning to offer their own renewable-energy focused products. For example, Clearwater Credit Union (based in Missoula, MT) offers two home energy loans: an unsecured, easy-access Home Solar Loan; and a Home Energy Efficiency Loan. Because it is a private institution (and not a state agency), the credit union can usually offer a decision in minutes. These options can be particularly attractive for businesses or households that already have an account with that institution.

Third-party financing is another option to consider. In this scenario, a private, third-party financer will develop a solar project on leased or purchased land or roof space. The financer provides the capital and, in doing so, is often able to take advantage of tax breaks that can lower the overall project cost. They enter into a contract with the system host (i.e., the building or land owner) who then benefits from the project by receiving the energy produced on-site. The host may pay the financer a regular payment (fixed or otherwise) related to the value of the energy delivered. At the end of the contract term, the host may also have an option to purchase the system from the financer. The crux is finding a third-party financer you are comfortable working with. These types of contracts can be technical, and the nuances are very important. If you are interested in this model, I recommend working with a legal expert to make sure you understand the terms and conditions of any agreement that you sign. Missoula County recently worked on the first third-party financed system in Montana. MREA hosted a webinar about the experience, and about third-party financing in general. A link to the recording is provided below.

A closing note on tax incentives (generally): Be sure to consult with a tax professional to ensure that these options are available to you. Unless the tax credit is specifically noted as refundable, you must have a sufficient tax liability to claim the value of the credit. For example, the Federal ITC is not currently refundable (though SEIA and other solar advocates have lobbied Congress to make it so).

As you can see, there are varied options available to help with the cost of a solar installation. However, the nuances are important and can drive the cost and savings that you will eventually realize. As you explore these different options, be sure to reach out to local solar advocates and legal and tax experts in your area with any clarifying questions.

Resources:

MREA webinar on Third-Party Financing

Montana-specific Programs and Examples:

MREA website on financing and incentives

Alternative Energy Revolving Loan Program

Clearwater Credit Union energy loans

Northwestern Energy E+ Renewable Incentives

[1] Solar Energy Industries Association. (2022). “Solar Industry Research Data.” https://www.seia.org/solar-industry-research-data